Ripple publishes the quarterly XRP Markets Report to voluntarily provide transparency and regular updates on the company’s views on the state of crypto markets, relevant XRP Ledger and XRP-related announcements, and market developments over the previous quarter.

As an XRP holder, Ripple believes proactive communication and transparency are part of being a responsible stakeholder. Moreover, Ripple urges others in the industry to build trust, foster open communication, and raise the bar industry-wide.

Crypto Markets Summary Q4 2023 was a historic quarter for crypto and broader macro assets. The D.C. Circuit Court’s rejection of the SEC’s case against Grayscale’s spot Bitcoin ETF application sparked the crypto rally at the end of October. Simultaneously, the Fed’s stance towards interest rates became more dovish, resulting in a broader market rally (U.S. stocks and bonds) as well. These two events were pivotal as they marked a bullish change in investor sentiment across the risk spectrum.

Despite a concerted effort by the SEC to stall approvals for Bitcoin ETFs, accelerated approval for 11 applications were granted across the board. On the first day of trading, cumulative Bitcoin ETF volume crossed $4.5 billion, with blue chip firms such as BlackRock and Fidelity dominating trading volume. While it’s still early innings, this was a watershed moment for the crypto industry and a signal of increased institutional adoption and demand among sophisticated investors.

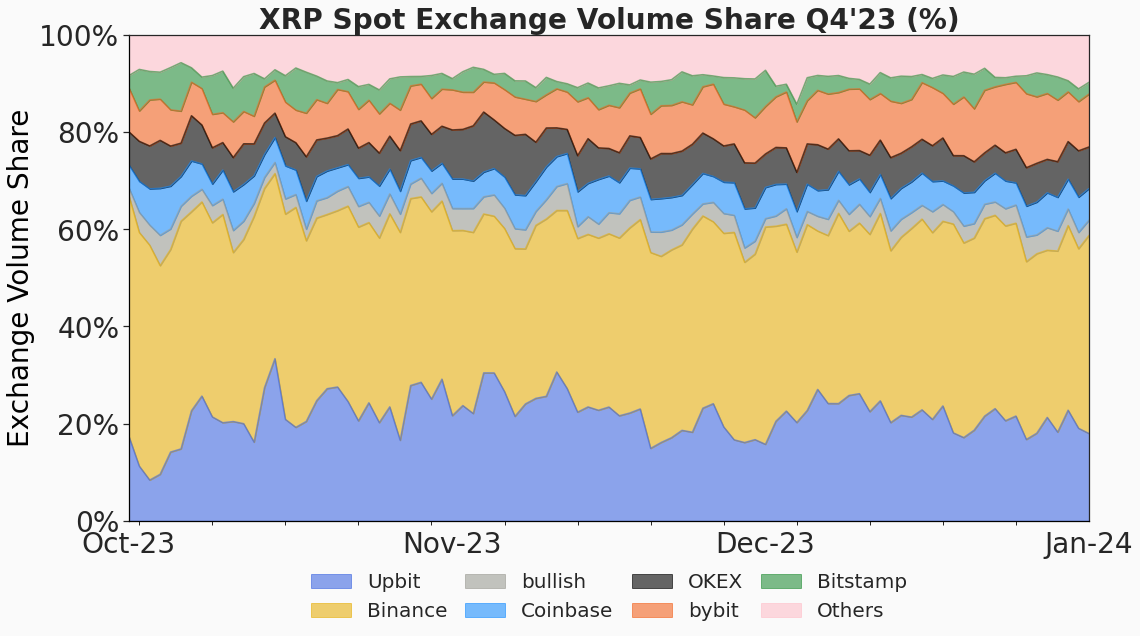

With Binance CEO Changpeng “CZ” Zhao stepping down due to the U.S. government’s investigation of the company’s compliance policies, many correctly speculated that volumes would begin to slowly migrate away from Binance. In a few short months, Binance lost ~15% of the market; beneficiaries included OKEX, Bybit, Upbit and Coinbase among others. The CME has also seen a massive spike in open interest (almost 300% to $6B in Q4) which now makes it the largest crypto derivatives venue for futures. While the most likely explanation for this jump in CME activity is ETF authorized participants hedging their position, it breathes air into an alternative venue for crypto assets and contributes towards further validation of the asset class. This migration has extended to on-chain speculation as well with perpetual DEX (leveraged trading venues) activity skyrocketing 300% over this period.

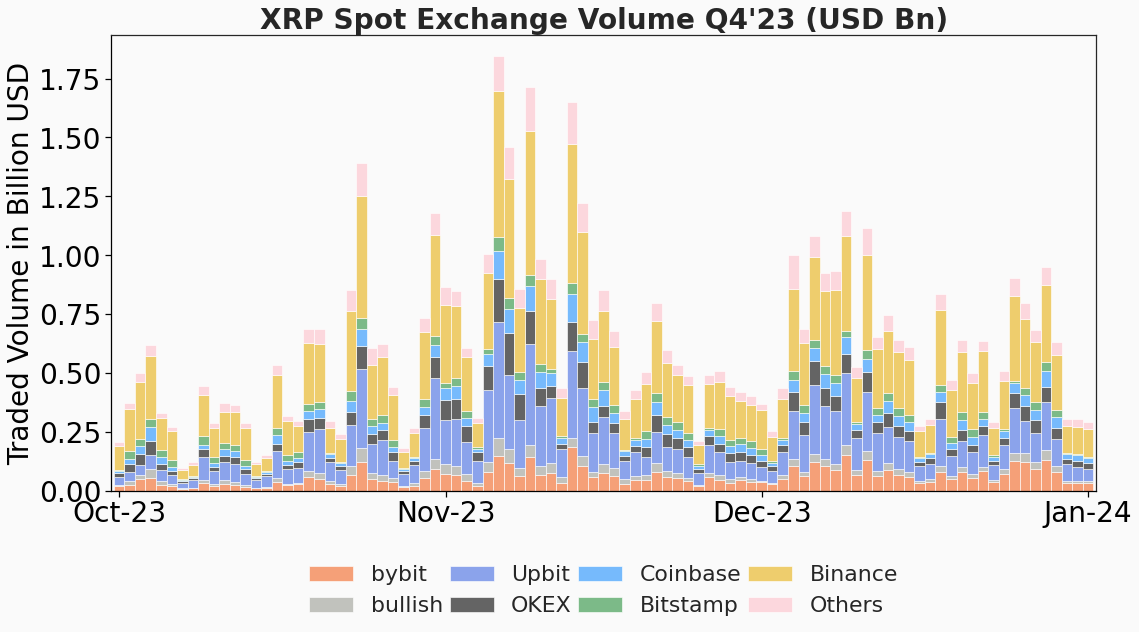

Spot XRP volumes rebounded strongly over Q4 with daily trading reaching $600M a day (up 75-100% from the lows of Q3). This is in line with the rest of the market which also saw BTC volumes up 88% QoQ, and ETH up 140% QoQ.

Looking forward, 2024 is a year with several potentially large-scale shifts in market structure as the market for approved ETFs develops as a signal of increased institutional interest in conjunction with investor appetite for “BTC proxies” such as Microstrategy, Coinbase, and various mining stocks.

Banner Year for Ripple Wins Against the SEC In 2023, significant legal victories in the United States marked a turning point for clarifying the legal status of XRP. On July 13, Ripple notched a critical victory in its hard fought litigation with the SEC, with the Court holding that XRP in and of itself is not a security under federal law. The Court also held that a majority of Ripple’s sales and distributions of XRP did not constitute investment contracts and were therefore lawful, including XRP transactions on crypto exchanges. After the Court’s July ruling, the Judge denied the SEC’s bid for an interlocutory appeal, and the SEC dismissed “with prejudice” all claims against Chris Larsen and Brad Garlinghouse personally, vindicating both. The ruling was a resounding win not just for Ripple, but for the entire crypto industry. It marked the first industry victory against the SEC and set a precedent for other tokens in the U.S., laying the groundwork for others to determine that tokens, in and of themselves, are not securities.

While Ripple celebrates its important victory, the company also acknowledges that the Court found that certain historical XRP sales that Ripple made to sophisticated entities — Institutional Sales — were investment contracts and therefore should have been registered with the SEC. Looking ahead, Ripple and the SEC will enter the “remedies” phase of the case, focused on Institutional Sales. Legal briefs will be submitted in March and April of this year and then the Court will decide which remedies to impose.

Even prior to the Court’s July ruling, Ripple had changed the way it sold XRP and going forward we will ensure that Ripple’s sales conform to the legal standards articulated by the court. Ripple will continue to raise the bar on compliance, ethics, and transparency and invest the resources necessary to ensure compliance with the law as it continues to evolve in this space.

Ripple Licensing Wins Licensing frameworks have helped establish regulatory clarity, attracting companies, entrepreneurs, investments, and fostering sustainable innovation. In Q4, Ripple (including subsidiaries) obtained licenses in major markets including its full Major Payments Institution license, granted by the Monetary Authority of Singapore (MAS) and its registration as a virtual asset service provider by the Central Bank of Ireland. To date, Ripple holds a NY BitLicense and has secured money transmitter licenses in nearly 40 jurisdictions in the U.S.

Q4 Global Regulatory Developments Convictions and enforcement actions shook up the industry in Q4 specifically in the U.S. SEC Chair Gary Gensler’s regulation by enforcement approach continued as they brought misguided lawsuits against large crypto players including Coinbase and Kraken, charging these companies with operating as an unregistered securities exchange. Recently, Coinbase asked the judge to dismiss charges, citing the lack of an investment contract, as well as the SEC’s gross overreach and attempts to expand its jurisdiction.

On November 2, FTX founder Sam Bankman-Fried was found guilty of all seven charges levied against him, cementing this case as one of the biggest financial frauds on record. Subsequently, Binance and its CEO CZ pled guilty to criminal charges and CZ stepped down as the company’s CEO as part of a $4.3 billion settlement with the U.S. Department of Justice. These convictions continued to bring back important topics to the forefront such as compliance, anti-money laundering and risk management.

Globally, the industry continued to see positive momentum as the Dubai Financial Services Authority (DFSA) opened external applications for tokens to become approved for use in the Dubai International Financial Centre (DIFC). XRP was one of the first tokens approved by the DFSA, and licensed firms within the DIFC can now integrate XRP into their virtual asset services, potentially unlocking faster and more efficient global value exchange.

The UK government announced that it will launch a Digital Securities Sandbox which includes debt, equity, and money-market instruments within the sandbox’s scope. Also, the UK’s Finance Minister will probe banking challenges faced by licensed crypto firms in the country to encourage innovation in the region. Spain announced it will aim to implement the EU’s seminal Markets in Crypto Assets (MiCA) legislation six months early, ahead of the July 2026 deadline. In Asia, Hong Kong has prepared regulations for tokenized real-world assets, and MAS announced its plans for pilots with Japan, Switzerland, and the UK for its asset tokenization project.

Deep Dive: XRP Markets For this report, Ripple uses market metrics from public sources including CCData, Bloomberg, and Refinitv Eikon.

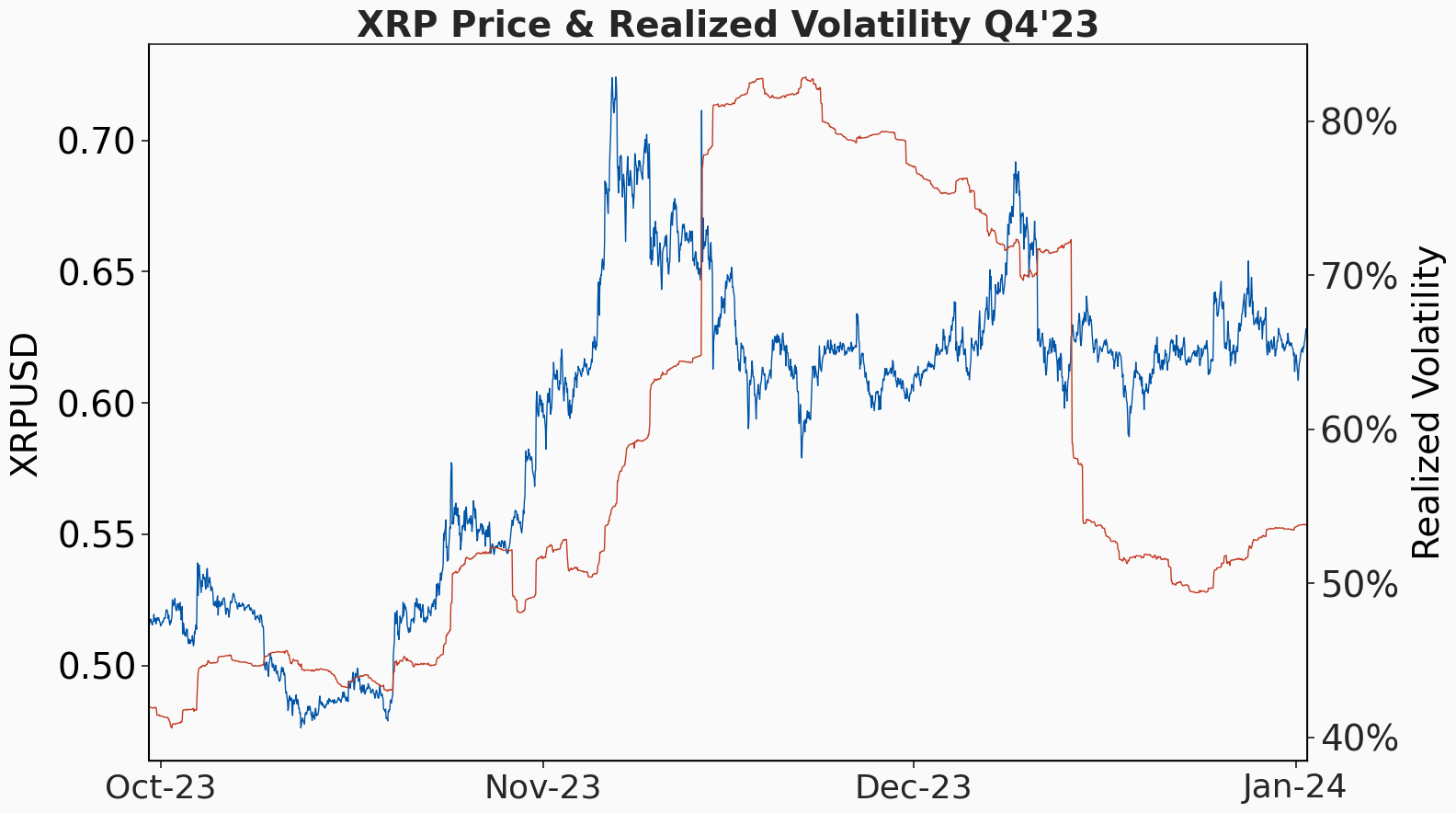

Chart 1: After reaching historical 90-day lows of ~45%, realized XRP volatility began steadily increasing, almost doubling by mid-November. The primary reason for this was the significant surge in XRP price, which mirrored the overall cryptocurrency market in October and November, reflecting the heightened anticipation of a potential BTC ETF.

Table 1: Major tokens price and volume (end of Q4 ‘23 figures)

Chart 2: Q4 saw increased trading volume for XRP spot pairs. Starting with an average daily spot volume of $300-450M in Q3, volumes (ADVs) doubled in Q4 in November before settling at around $600M at year’s end. Overall, ADV in Q4 increased 75-100% from the lows of Q3.

Chart 3: The percentage share of volume traded through fiat pairs in Q4 remained similar to the previous quarter, hovering around 15%. The vast majority of XRP trading activity is currently with stablecoins, of which the most trading is against USDT.

Chart 4: XRP volume has been migrating slowly from Binance to other exchanges including bybit, Upbit, Coinbase, OKEX and others.

The State of the XRP Ledger

In Q4, the validator voting process for XLS-30 commenced on the XRP Ledger (XRPL). This amendment adds a non-custodial automated market maker (AMM) as a native feature to the XRPL’s decentralized exchange (DEX). With XRPL's inherent advantages of low transaction fees and speed, XLS-30 can help enhance liquidity and market efficiency, acting as liquidity aggregators and making funds available based on predefined algorithms.

As new amendments and developments are made on the XRPL, security audits play a vital role to ensure the software meets industry standards and maintains a robust defense against evolving digital threats. On October 6, Bishop Fox delivered remediation reports for the EVM Sidechain and the XLS-38 Cross-Chain Bridge. The results did not find any critical or high severity issues, and all of the reports are listed here.

Lastly, several notable projects in the community brought more innovative use cases and utility to the XRPL:

Uphold launched its self-custody wallet Vault that will initially support XRP with plans to expand to Bitcoin in the beginning of next year.

DappRadar announced the integration of the XRPL, enabling access to data and insights on apps within the XRPL ecosystem, tracking their performance and key metrics.

Band Protocol announced its integration with the XRPL making it the primary oracle provider for XRPL's mainnet and its EVM sidechain.

Atato Digital Asset Custody plans to integrate with Cronos Chain and the XRPL, streamlining the coding processes to protect and support tokens across both EVM and non-EVM chains.

For more information on the XRPL ecosystem, XRPL Commons, a non-profit association focused on educating and empowering the global XRPL community, published a community magazine recapping technical developers and key projects.

On-Chain Activity Last quarter, on-chain transactions increased by 34% and the number of wallets increased by over 30%. More than half of all-time NFTs minted took place in Q4, increasing more than 400% compared to Q3.

To date, the NFT use case continued to gain traction, with more than 5M mints and more than 1M sales, totaling nearly $10M in sales volume.

On-Chain Activity | Q3 2023 | Q4 2023 | QoQ |

|---|---|---|---|

Transactions | 90,446,746 | 121,031,713 | +34% |

XRP Burned for Transaction Fees | 243,201 | 317,271 | +30% |

Avg Cost per Transaction (in XRP) | 0.00269 | 0.00262 | -3% |

Average XRP Closing Price (in USD) | 0.55 | 0.59 | +7% |

Avg Cost per Transaction (in USD) | 0.001490 | 0.001546 | +4% |

Volume on DEX (in USD) | 218,610,501 | 54,907,170 | -75% |

Trustlines | 7,583,330 | 7,406,366 | -2% |

Number of New Wallets | 157,936 | 208,522 | +32% |

Compromised XRP Wallets

Last week, there were a number of unauthorized transactions moving XRP out of several wallets belonging to Ripple co-founder Chris Larsen. Law enforcement was quickly brought in and exchanges were notified to flag addresses and freeze funds. The XRPL Foundation has continued to help by tracking, sharing, and analyzing relevant data around the situation.

This was an isolated incident, and Ripple wallets have not been compromised.

Ripple’s XRP Holdings

Ripple reports information about its XRP holdings at the beginning of the quarter and last day of the quarter. Its holdings fall into two categories: XRP that it currently has available in its wallets, and XRP that is subject to on-ledger escrow lockups that will be released each month over the next 42 months.

For this latter category, Ripple does not have access to that XRP until the escrow releases it to Ripple on a monthly basis. The vast majority of the XRP released is put back into the escrow each month.

September 30, 2023 Total XRP Held by Ripple: 5,258,162,324 Total XRP Subject to On-Ledger Escrow: 41,300,000,005

December 31, 2023 Total XRP Held by Ripple: 5,077,658,695 Total XRP Subject to On-Ledger Escrow: 40,700,000,005

*This report has been updated to reflect the latest information.