Ripple publishes the quarterly XRP Markets Report to voluntarily provide transparency and regular updates on the company’s views on the state of crypto markets such as quarterly XRP sales, relevant XRP-related announcements, and commentary on market developments over the previous quarter.

As an XRP holder, Ripple believes proactive communication and transparency are part of being a responsible stakeholder. Moreover, Ripple urges others in the industry to build trust, foster open communication and raise the bar industry-wide.

Crypto Market Summary Crypto markets sold off in the first quarter of 2022 due to a combination of regulatory, macroeconomic, and geopolitical factors. Many speculated that record inflation rates and the Federal Reserve’s first rate hike in three years were the main narratives driving trading activity at the start of the quarter. By February, the market’s attention shifted focus to the growing tensions in Eastern Europe, and Russia’s invasion of Ukraine. By March, the focus was on Biden’s long-awaited Executive Order (EO) on crypto as well as the evolving regulatory landscape in Europe such as the MiCA regulation. The EO received a generally positive reception from the crypto industry, helping spur the rally seen at the end of the quarter.

Notably, BTC and equity markets were highly correlated last quarter. According to data from Bloomberg, the correlation between Nasdaq100 and BTC reached new all-time highs and similarly, the 90-day correlation of BTC and S&P 500 also hit a new 17-month high in March. These growing correlations reignited the age-old debate of whether BTC is digital gold or a risk-on asset.

NFT Spotlight The NFT market broke records last quarter as total marketplace volume surpassed a whopping $35B. After months of speculation, the LooksRare platform launched in January, allowing NFT traders to claim and stake $LOOKS based on their NFT traded volume in 2021. Using a similar strategy to Sushiswap’s vampire attack on Uniswap, LooksRare drained liquidity from competitor OpenSea by charging 50bps lower fees and distributing them to $LOOKS holders. A month after launch, LooksRare’s native token plunged more than 60% to $2.20 after severe community backlash from the team cashing out over $30M in WETH. LooksRare continued to deliver on volume with $21B in Q1, although wash trading with royalty-free collections was likely inflating this volume.

The LayerZero protocol launched in March, allowing smart contracts to communicate across Ethereum Virtual Machine (EVM)-compatible blockchains. Shortly after launch, the LayerZero Labs team dropped gh0stly gh0sts, the first ever interoperable NFT collection. Gh0stly gh0sts could be minted for free from 7 different chains, creating a new standard for NFT cross-chain interoperability.

Bored Ape Yacht Club went beyond flipping punks this quarter with Yuga Labs’ acquisition of IP rights for CryptoPunks and Meebits from LarvaLabs. This transaction put a spotlight on IP ownership in the NFT space, forcing major projects to explicitly state their position on this matter. Creative Common 0 (“CC0”) projects like Cryptoadz or Nouns DAO released IP rights to the public domain and accumulated treasury funds that can be used by the community. Wassies took a different route with a hybrid collection of CC0 NFTs and a perpetual IP trust structure.

The XRP Ledger (XRPL) in the NFT Space Since the launch of the Creator Fund, Ripple has received over 4,000 applicants for NFT projects across gaming, metaverses, entertainment, art and more for NFTs on the XRP Ledger. The XRPL has some inherent advantages for tokenized assets such as low cost efficiency (near 0 fees to mint), no smart contract requirements for basic functionality, and was the first major blockchain to be carbon-neutral.

Several recipients to date who are building state-of-the-art NFTs include xPunks, Steven Sebring and Justin Bua. The Creator Fund provides the financial, creative and technical support needed for creators to engage and deliver new NFT use cases on the XRPL. Ripple has also teamed up with creative agencies and NFT marketplaces that will integrate with the XRP Ledger to deliver a seamless NFT experience for developers.

In April, VSA Partners, a creative agency partner to Ripple’s Creator Fund, announced its partnership with Rare Air Media — the producer of NBA Hall of Famer Michael Jordan’s visual autobiography For the Love of the Game — to design, develop, and market a range of NFTs on the XRPL, including a one-of-a-kind selection of digital assets covering Jordan’s career.

XLS-20 update rippled 1.9.0 was released with key contributions from RippleX, including XLS-20, on Devnet. While the team is excited to contribute additional NFT functionality to the XRPL, stability and scalability remain key priorities for the XRPL community. As with any new feature to a public blockchain, NFT functionality will bring considerable additional transaction volume to the XRP Ledger. As such, the Ripple-managed validators on the XRPL voted against bringing XLS-20 to XRPL Mainnet at this time, as Ripple believes additional performance testing should be conducted to better understand NFTs’ impact on the XRP Ledger at a large scale. Enabling a native NFT object on the XRPL requires 80% of validators to vote in favor of XLS-20. As one contributor to this growing XRPL community, Ripple is not in a position to determine the outcome of enabling XLS-20 alone—that will be up to the collective XRPL community. Currently, Ripple operates only 4 of 144 known validators on the XRP Ledger (less than 3% of the total).

XRPL Interoperability The XRP Ledger saw key cross-bridge integrations with Multichain and Allbridge, both of which allow XRP holders to move their XRP to 12 different blockchains, including Avalanche, Fantom and Solana, as well as move the top coins from these chains onto the XRPL. In addition, WXRP, issued by HexTrust in conjunction with wrapped.com, has also seen an increase in circulation with almost 16M XRP floating in the ETH ecosystem. Currently, WXRP can be minted on Binance.com and soon via onxrp.com through a decentralized bridge.

Tokenization on XRPL’s Decentralized Exchange (DEX) The XRPL’s built-in DEX enables near-instant, low-cost settlement and liquidity for assets of all kinds. Native functionality such as auto-bridging allows assets transferred to the XRPL to access the DEX’s existing liquidity to create synthetic order books for assets. Pathfinding functionality also allows assets to find the most efficient path for a trade.

Current gateways into the DEX include GateHub, Sologenic, and onXRP.com. GateHub enabled trading for four assets, including USDC and USDT, as wrapped assets on the XRPL. Users can bring these top ERC-20 stablecoins to the XRPL’s built-in DEX and create markets. STASIS, an established leader in euro-backed stablecoin production, announced it will issue the EURS stablecoin on the XRPL due to its scalability, speed, low cost and carbon neutrality. This also provides developers, institutions and consumers who hold EURS with easy on and off-ramps needed to create great user experiences for their crypto products. EURS is the leading euro stablecoin and among the top 10 stablecoins globally.

Global Regulation Last quarter, Ripple launched a policy paper in South Korea outlining recommendations for policymakers and regulators during a time of increased attention on crypto in the region. In partnership with GBCKorea and Oxford Metrica, the paper proposes adopting a digital asset taxonomy aligned with global best practices - providing a clear distinction between payment, utility, and security tokens - and implementing a risk-sensitive digital asset regulatory framework in order to strike the right balance between consumer protection and innovation. Regulators in Asia Pacific and Middle East also consulted on the appropriate regulation of digital assets and intermediaries in Q1, including the Hong Kong Monetary Authority, Bank of Thailand, Dubai Financial Services Authority, and Financial Services Regulatory Authority of Abu Dhabi Global Market.

Several regulators continued to embrace crypto as licenses from Singapore’s Monetary Authority of Singapore, Dubai’s Virtual Asset Regulatory Authority and Portugal’s Banco de Portugal were granted to Paxos, FTX and Bison Bank, respectively. Notably, the UK Financial Conduct Authority (FCA) made waves as it sunsetted its temporary registration regime, resulting in the multiple crypto companies withdrawing their applications. In response, the FCA gave an extension to a “small number of” firms, including Revolut and Copper, where it was deemed “strictly necessary.”

In the U.S., President Biden signed an executive order which sets out a national strategy to promote crypto innovation while protecting against possible risks. The EO affirmed what Ripple has been saying for years: that the crypto economy is massive and growing, and that it presents a tangible opportunity for equitable and inclusive financial services for all Americans. Notably, the EO highlighted the need for evolution and alignment of the U.S. government’s approach to crypto instead of its current fractured response to regulation. While this is a step in the right direction, the industry has been asking for regulatory clarity for years and existing legislative proposals should not await an extended round of study by the federal government.

In accordance with this, House Representatives Thompson, Khanna, Emmer and Soto recently re-introduced the Digital Commodities Exchange Act (DCEA) which gives the CFTC primary regulatory authority for oversight of spot digital commodity markets. The bill was originally introduced in 2020, and builds on existing frameworks that the CFTC has used to effectively regulate commodities markets for decades.

Lastly, the important role of compliance in crypto was discussed on the global stage as many speculated on the possibility of Russia evading sanctions using crypto. However, both federal government officials and the crypto industry agree – that because government entities are adept at tracking crypto that is either stolen or sent and received by sanctioned entities, Russia would not be able to use it as a fallback. In addition, to convert crypto into fiat, payments must go through endpoints, the majority of which are regulated. Note, RippleNet and its customers abide by OFAC sanctions and KYC/AML requirements.

Q1 (and part of Q2 2022) Update on the SEC Lawsuit against Ripple On March 11, the Court denied the SEC’s request to strike Ripple’s fair notice defense recognizing that there is a serious question whether Ripple had fair notice that its distributions of XRP could be perceived to violate securities laws. The expert discovery deadline was reopened by court order to May 13, 2022 to allow Ripple time to re-depose one of the SEC’s experts who served a late filed report. On April 11, Judge Netburn denied the SEC’s request to reconsider her prior order requiring the agency to produce communications related to and drafts of a June 2018 speech by former SEC director William Hinman, which included remarks on why he didn’t consider bitcoin and ether to be securities.

Motions for summary judgment by both Ripple and the SEC will be filed later this year. We continue to push hard for a speedy resolution and look forward to proving that Ripple did not violate securities laws, and that the SEC never provided Ripple with fair notice its actions would ever be prohibited under the law.

RippleNet Kicks Off Year with Record Numbers Q1 2022 was a record quarter for On-Demand Liquidity (ODL) as volume grew considerably with nearly 8x YoY growth. Overall, RippleNet saw a $15B annualized payment volume run rate marking unprecedented growth as customers use ODL for several different use cases beyond traditional remittances or individual payments, including treasury and bulk SME payments.

Disciplined, Responsible Stakeholders: Q1 Sales and Purchases Last quarter, total XRP sales by Ripple, net of purchases, were $273.27M vs. $717.07M USD the previous quarter. Ripple has continued to engage in sales related to ODL and these volumes have ramped up substantially as Ripple’s ODL business expanded as well. As has been the case since Q4 2019, Ripple did not conduct programmatic sales in Q4.

Sales Summary (dollars in millions) | Q4 2021 | Q1 2022 |

|---|---|---|

Total ODL-related sales* | 1,039.04 | 1,354.29 |

Total purchases | 321.97 | 1,081.02 |

Sales (net of purchases) | 717.07 | 273.27 |

Global XRP volume | Q4 2021 | Q1 2022 |

|---|---|---|

ADV XRP (dollars in millions) | 1,830.89 | 1,105.29 |

Total XRP volume (dollars in billions)** | 168.41 | 96.83 |

Net sales as % of total volume | 0.43% | 0.29% |

*All ODL-related sales are attributed to the growth and adoption of ODL

**Note: Figures were compiled using the CryptoCompare API for daily TopTier aggregate volumes which reflects total XRP volume in dollars by exchanges that CryptoCompare lists in the TopTier.

Ripple has been a buyer of XRP in the secondary market and expects to continue to undertake purchases at future market prices as ODL continues to gain global momentum.

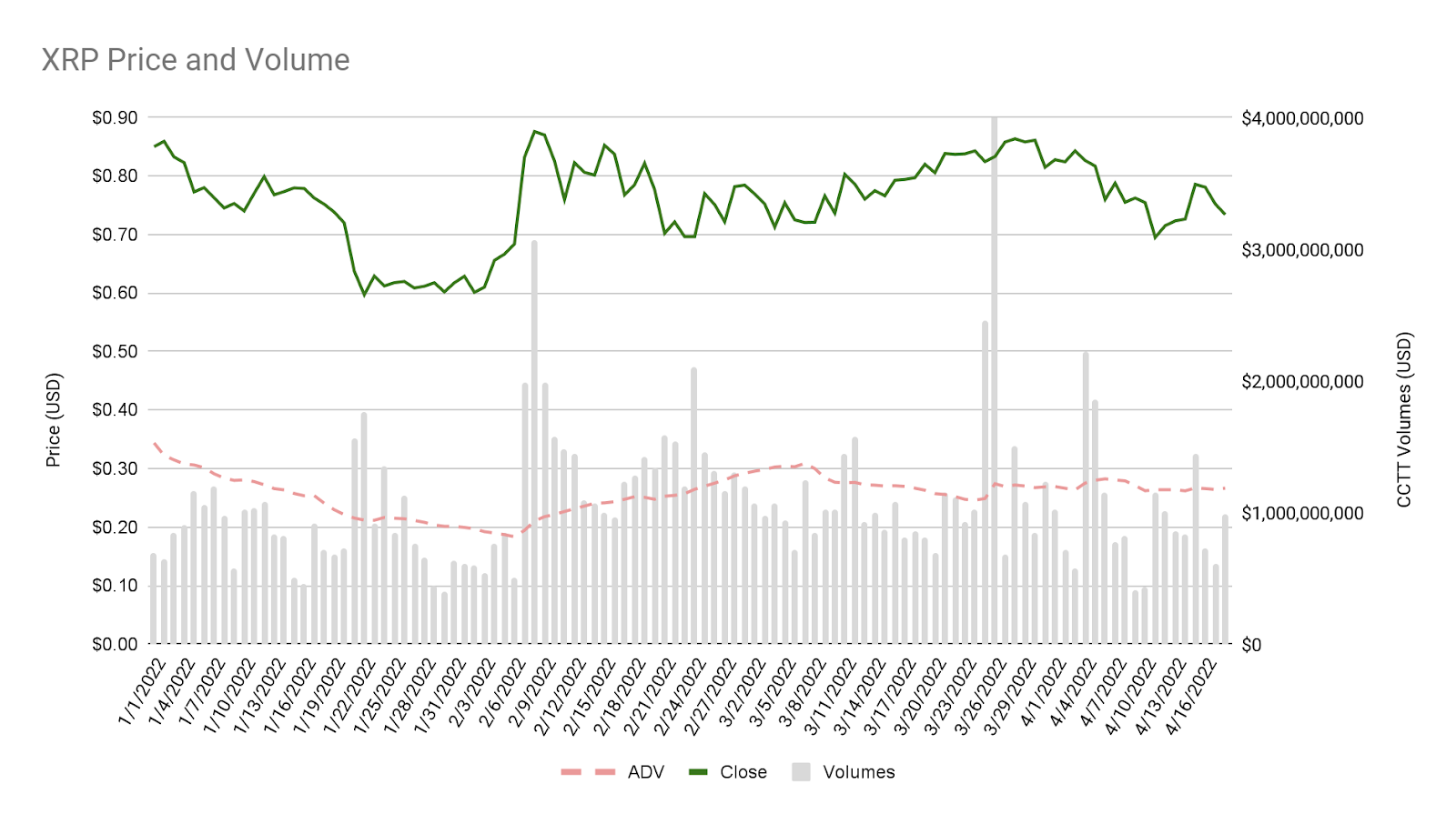

Total sales by Ripple, net of purchases, ended the quarter at 29 bps of global XRP volume according to CryptoCompare TopTier (CCTT) volumes.

Leases Certain wallets that are being used for XRP sales also provide short-term leases to market makers. This is worth noting given they are often incorrectly interpreted by market participants as sales. Leases are ultimately returned to Ripple. Total amount of leases outstanding in Q1 2022 was 95.3 million XRP.

Reported Volume and Price

XRP price remained buoyant, staying largely range-bound for the quarter compared to other large tokens, despite a decline in volumes and in the face of broader macro cues and BTC price action.

Volumes have declined 39% QoQ to an ADV of $1.1B down from $1.8B.

Escrow In Q1 2022, three billion XRP were released out of escrow (one billion each month) in line with prior quarters and the official escrow arrangement. In total, 2.4 billion XRP were returned and subsequently put into new escrow contracts throughout the quarter. For more information on the escrow process, see here. Note: All figures are reported based on transactions executed during the quarter.

Building with the XRP Ledger Community Last quarter, there were a total of 140.8M transactions on the XRP Ledger with $61.1B via 80.8 billion XRP in volume. The community continued to create and advance more projects and apps to address a variety of use cases.

Notably, CarbonlandDAO and Trust aims to protect forest biodiversity and capture CO2 through the issuance of ESG NFTs; AnChain.AI is building a blockchain intelligence platform for security, risk and compliance; and Ledger City is launching a game where crypto holdings are represented visually in a 3D cityscape.

NFT projects gained momentum as developers began building innovative solutions on the XRP Ledger. Projects such as Pixel Ape Rowboat Club and xShrooms came on the scene providing new avenues to support the creator community. In addition, developers participated in an XRPL Hackathon, and winners showcased their functional NFT projects to the community:

ERC721 to XLS20 Decentralized NFT Bridge

: a one way decentralized NFT bridge from ERC721 to XLS20.

: a machine learning platform that generates reports for uploaded data files, and issues NFTs as certificate of ownership.

: a platform that allows individuals to give rewards in the form of a functional NFT using IPFS, minted on the XRP Ledger.

Ripple Commits 1 Billion XRP to Advance XRPL Projects

Ripple announced a 1B XRP commitment to the XRPL Grants program to advance XRPL projects and support the independent developer community building projects of all types on the XRP Ledger. To date, with more than 400 applicants, XRPL Grants distributed over $6M to 50+ open-sourced projects, covering a variety of use cases from Federated Sidechains to NFTs and more. In Q1 2022, XRPL Grants received over 170 applications for the third wave of the program. These projects are being reviewed by an independent judging committee composed of academics and builders well-respected in their fields from around the world, including a number of University Blockchain Research Initiative (UBRI) partners. The program plans to announce the Wave 3 grantees around the end of Q2.