Digital Asset Custody: Building Institutional Resilience, Compliance, and Scaled

Expand your suite of offerings with digital assets and gain competitive advantage

Diversify your bank’s portfolio, increase margins and open new revenue streams with stablecoins and digital assets.

Ripple’s payments and digital asset custody solutions are built on secure distributed ledger technology, with a reliable global payout network and a proven track record of regulatory compliance. Our solutions provide access to the entire digital asset ecosystem, and with over a decade of experience in both traditional finance and crypto, we’re with you every step of the way.

Why banks choose our digital custody solution

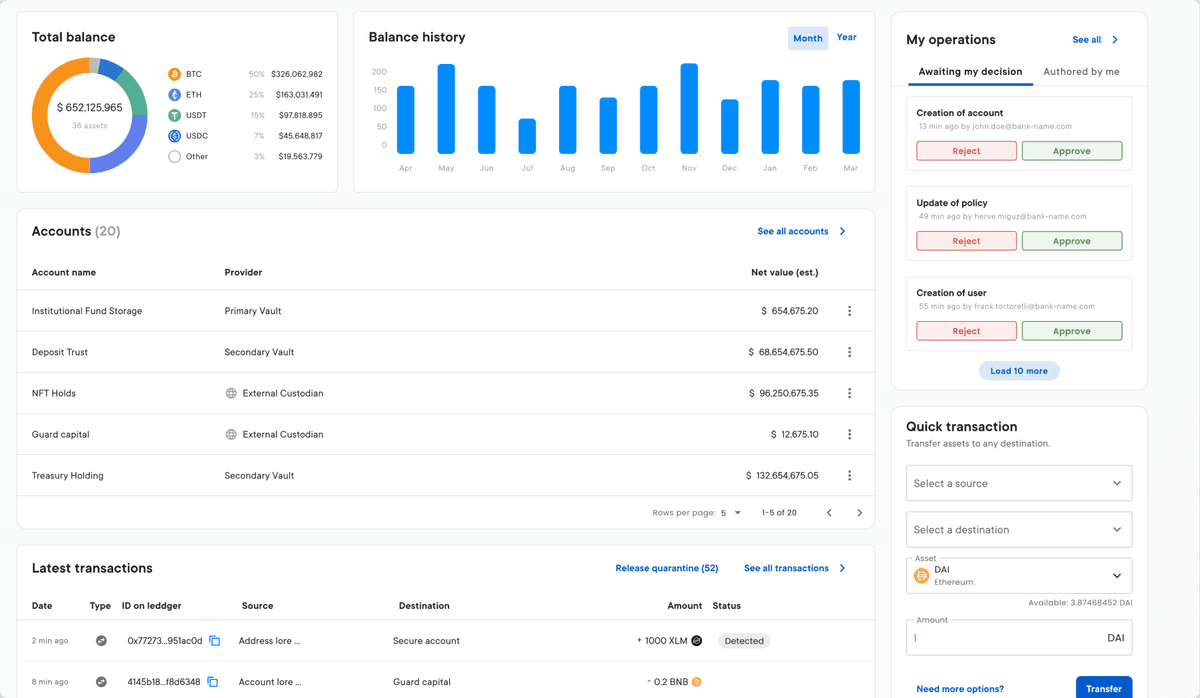

Engage in asset tokenization

Safely hold, manage, trade and transfer digital currencies and tokenized assets with bank-grade security.

Become a digital asset custodian

Future-proof your business by safeguarding and servicing digital assets with secure orchestration, configurable policy and governance engines.

Tap into new asset classes

Satisfy client demand and diversify your portfolio with customizable custody for your growth needs, including on-premise or cloud-based SaaS deployment and key management optionality.

Why banks choose our cross-border payments solution

Integrate stablecoins into your payments stack

Enable round-the-clock, 24/7/365 cross-border payments settlement using stablecoins and our suite of licenses.

Expand your reach

Access instant third-party payouts in stablecoins or local currency in over 90+ markets globally, including Latin America, Africa and China.

Meet the need for speed

Respond to market demand with agility, powered by a modern payments infrastructure and transactions that settle in seconds.

Read the latest for banks