XRPL EVM Sidechain Mainnet is Live: Smart Contracts Meet XRP Reliability

Move and manage value at the speed of crypto

Crypto liquidity providers and exchanges can accelerate growth and increase liquidity with dependable access to crypto-friendly payment rails—no banking relationship required.

Ripple’s enterprise-grade solutions provide crypto businesses with a single platform to easily launch and scale new digital asset offerings and stablecoin on/off ramps. Make payouts in local fiat currencies with payout networks around the world and scale your business in the token economy—all without compromising security, compliance and operational efficiency.

Why crypto businesses choose our stablecoin payments solution

Unlock access to USD globally

Leverage Ripple’s crypto payments platform to bypass correspondent banking rails and get access to USD-backed stablecoins and equivalents globally.

Enhance your cross-border payments flows

Easily move in and out of crypto and fiat currency via a single connection, with flexible funding options and stablecoin pay-in/pay-out capabilities for cross-border payments.

Reduce the cost of international expansion

Offer competitive pricing to your customers via pre-negotiated rates, and build your own stablecoin payments infrastructure without the heavy resourcing requirements.

Why crypto businesses choose our digital asset custody solution

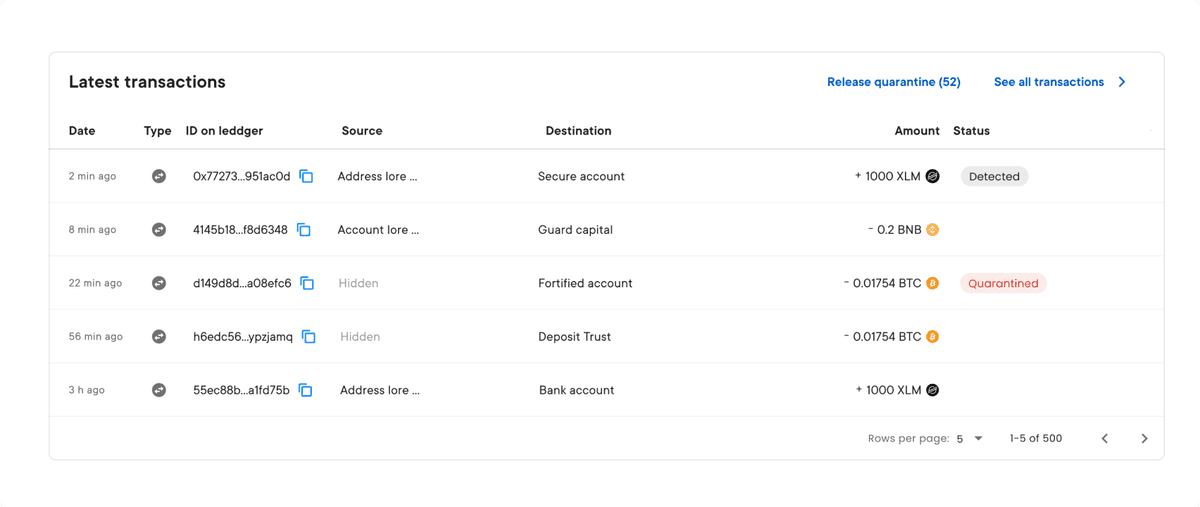

Balance security with flexibility

Choose your preferred key management system and secure custody setup, designed to meet your unique business needs.

Safeguard with cold storage

Reduce the risk of human error and security threats while maintaining 24/7 on-demand transaction approvals with complete audit capabilities.

Build a globally compliant offering

Get up and running quickly with new use cases across tokenization, trading, staking with compliance-focused pre-set policies and best practices.

Partnering with Ripple allows us to bring that regulatory compliant mindset and the technology for our institutional clients so that they can have peace of mind when they're working with BDACS that they're leveraging a robust, battle tested solution and worldwide network, to be able to expand on their digital asset business.

Terry Kim

Co-Founder and Chief Strategy Officer at BDACS

Read the latest for crypto businesses