Ripple publishes the quarterly XRP Markets Report to voluntarily provide transparency and regular updates on the company’s views on the state of crypto markets, relevant XRP Ledger and XRP-related announcements, and market developments over the previous quarter.

As an XRP holder, Ripple believes in proactive communication and transparency, and urges others in the industry to build trust, foster open communication, and raise the bar industry-wide.

Crypto Markets Summary

There was no shortage of notable market developments in Q1, including continued demand for BTC Spot ETFs in the US, centralized and decentralized exchange volume growth, key regulatory and legal updates, and technical blockchain upgrades.

BTC ETFs registered total net inflows of nearly $12B with cumulative trading volumes reaching $207B in just three months. BlackRock saw net inflows of $67B across its 400-plus fund ETF range, and its iShares Bitcoin Trust (IBIT) notched roughly $13.9B. Given the continued volume and inflows, it’s clear that traditional institutional investors saw large asset managers as an entryway to access the crypto market.

While crypto traders have previously utilized leverage to gain directional exposure, markets are undergoing a mini-renaissance period. Key examples of this era of leverage and an uptick in demand include ETF Authorized Participants hedging their inventory on the CME, projects like Ethena amassing $2B in delta-neutral assets, and funding rates entering never-before-seen territory. As a result, participants like these are demanding more trading infrastructure to execute their strategies. In addition, as prime brokers, settlement networks and tri-party solutions become second-nature in the market, the velocity of trusted assets will likely only increase, helping the market to continue to mature and grow.

Total centralized exchange volume in March surged to levels not seen since May 2021 highs. Spot volumes jumped to $2.93T in March, while derivatives volumes jumped to $9.1T per CCData. Decentralized exchange weekly volumes also spiked to $40B, a 100% increase over Q4 ‘23.

XRP spot volumes (Average Daily Volumes) surged to $865M in Q1 ‘24, representing a 40% increase from Q4 ‘23. Daily average XRP derivatives open interest was $500M in Q1 ‘24 vs $460M in Q4 ‘23. Spot volumes and open interest have continued to exhibit high correlation with general market activity pointing towards robust XRP trading and activity across venues.

Lastly, the industry saw several technical upgrades that helped lower barriers of entry for individuals and institutions alike into crypto including Coinbase’s plans to bring users fully on-chain via its wallet app and Ethereum’s Dencun upgrade, which has dramatically reduced gas costs for L2s. These upgrades, combined with Tier-1 asset managers stepping into the space to not just offer ETFs but other securitized products, all point to a new chapter in the road to mainstream adoption.

The SEC Lawsuit Against Ripple

On March 22, the SEC submitted to the Court their request for remedies against Ripple for its historic Institutional Sales of XRP. The SEC has asked the court for ~$2B which comprises: (1) ~$900M in disgorgement; ~$200M in prejudgment interest on the disgorgement request; and (2) ~$900M in penalties. The SEC also asked for an injunction.

Ripple filed its opposition to the SEC’s request on April 22 pushing back on the SEC’s baseless request arguing that the law does not allow for disgorgement (or interest on disgorgement) where the SEC has not proven that anyone was harmed. Ripple argued that a penalty of no more than $10M would be appropriate in a case that involves no allegations of fraud or recklessness. The SEC replied to Ripple’s brief on May 6.

In terms of next steps, both parties will wait for the Judge to make a determination on the final remedies - likely in the coming months. Ripple remains confident that the Judge will approach the remedies phase fairly.

Global Regulatory Developments

Stablecoin regulation was front and center as EU regulators published draft regulatory standards under Europe’s Markets in Crypto-Asset Regulation (MiCA) for stablecoin issuers. Due to come into force at the end of June, MiCA paves the way for global stablecoin regulation adoption and will push the market to adopt increasingly stringent and more transparent compliance measures. In addition, Hong Kong introduced a regulatory sandbox for stablecoin issuers this year and the BIS issued regulatory recommendations for global stablecoin arrangements. In the U.S., Senators Gillibrand and Lummis introduced a new stablecoin bill, with the goal of creating a regulatory framework for payment stablecoins.

The Virtual Asset Regulatory Authority in Dubai granted a conditional virtual asset provider (VASP) license to Deribit, the Monetary Authority of Singapore (MAS) granted in-principle approval for its payment license to OKX and South Africa’s financial regulator announced over 300 crypto asset providers sought approvals for a license in the country. In addition, MAS introduced amendments to the Payment Services Act, bringing activities such as crypto custody services within the regulatory perimeter.

Meanwhile, in the US, the SEC appears to be opening up new battlefronts in its war on the crypto industry, reportedly investigating ETH and issuing subpoenas to US firms over their interactions with the Ethereum Foundation. Subsequently, Consensys sued the SEC over its power grab over Ethereum, citing regulatory overreach. The SEC reportedly also sent Wells Notices to Uniswap and Robinhood. In its lawsuit against Coinbase, a judge denied parts of Coinbase's motion to dismiss. At this early stage of the proceedings, the Court was required to accept all the SEC’s allegations as true and found it plausible that Coinbase was acting as an unregistered exchange for certain tokens that may be securities. Additionally, the Court suggested that Coinbase’s staking services may constitute as unregistered security transactions. However, the allegation that Coinbase's wallet acts as an unregistered securities exchange alone failed, leading to its dismissal. As of the date of this report, Coinbase is seeking permission to appeal the adverse rulings.

The DOJ charged KuCoin and its founders with violating anti-money laundering laws while in parallel, the CFTC charged KuCoin for operating an illegal digital asset derivatives exchange. FTX founder and former CEO Sam Bankman-Fried was sentenced to 25 years in prison for his conviction on seven different fraud and conspiracy charges, and Binance founder Changpeng Zhao was sentenced to four months after pleading guilty to money laundering violations.

Deep Dive: XRP Markets

For this report, Ripple uses market metrics from public sources including CCData, Bloomberg, and Refinitv Eikon.

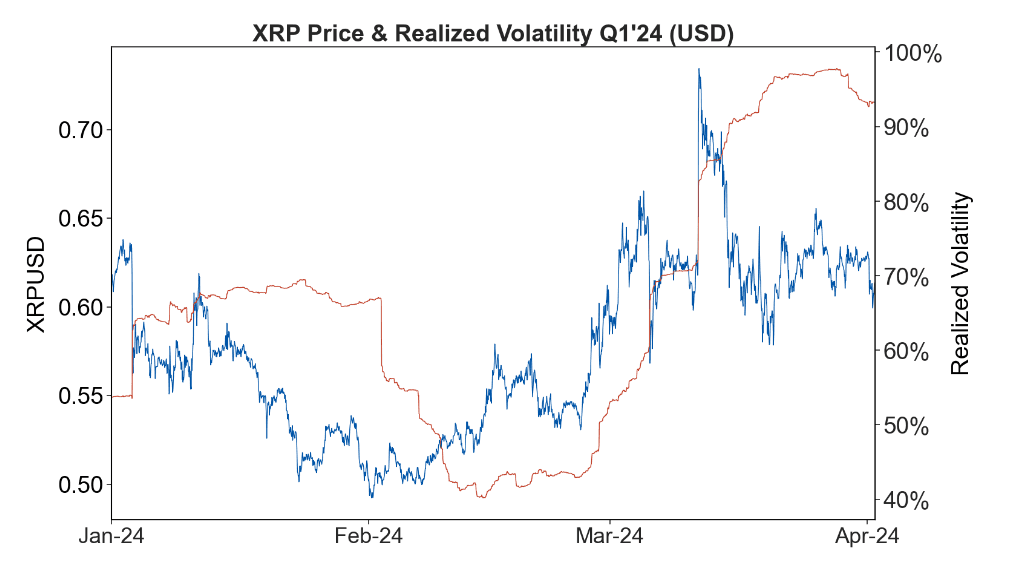

Chart 1: The low point in the quarter for XRP's price occurred in mid-February and peaked in March. The realized volatility showed a gradual decline, racing its bottom of just above 40% in February, and then increasing quickly in March. Despite the price increase towards the end of Q1, the volatility levels remained elevated above 90%.

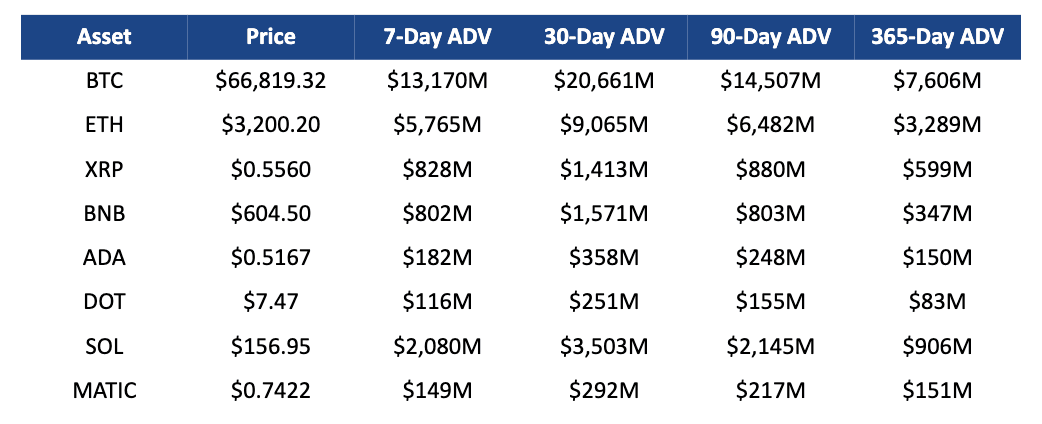

Table 1: Major Tokens Price and Volume (end of Q1‘24 figures)

USD prices and average trading volume reflects daily trading activity for the USD and stablecoin pairs on top tier exchanges as measured by CCData.

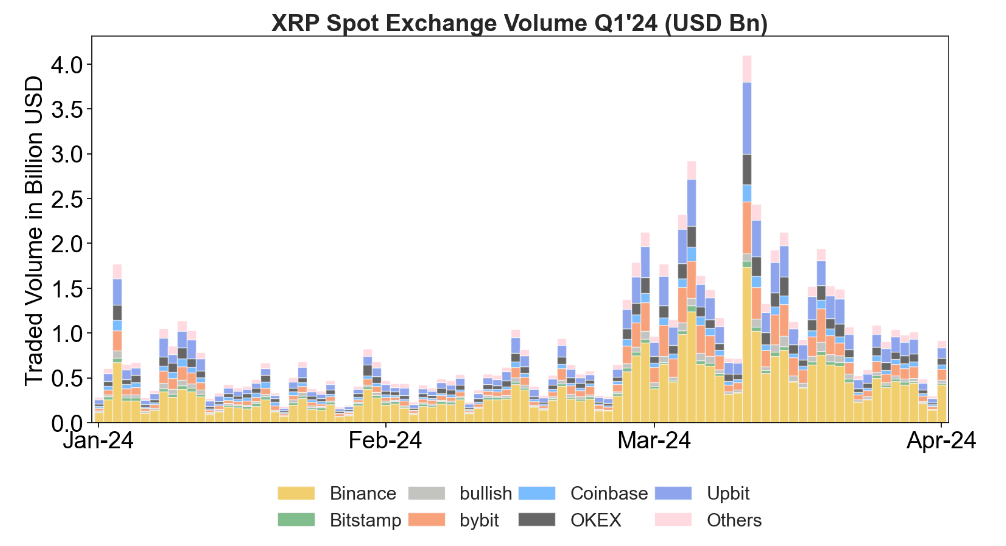

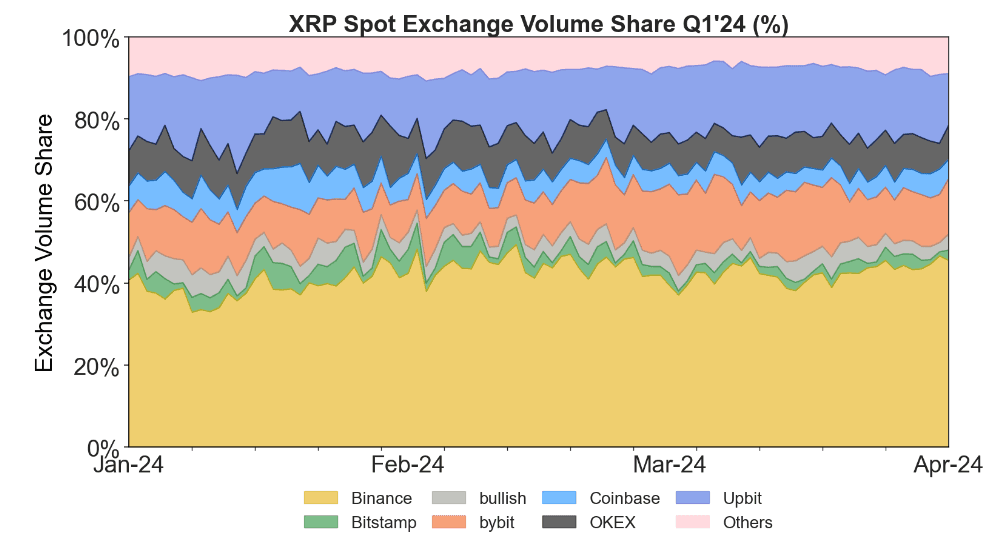

Chart 2: XRP Spot Exchange Volume

Binance continued to account for a significant portion of the volume while contributions from different exchanges vary. Coinbase, Bitstamp, and Upbit also combined for a significant percentage of volume.

Chart 3: XRP volume distribution across exchanges remained fairly constant through the first quarter of the year with Binance, Bybit and Upbit responsible for well over 70% of the total traded volume.

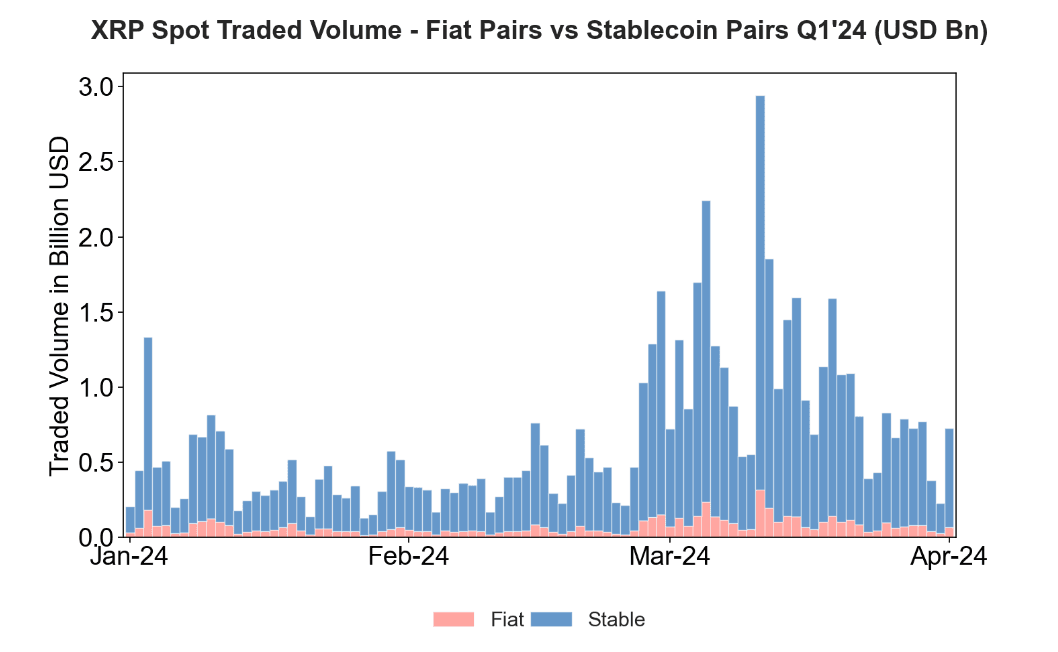

Chart 4: The percentage share of volume traded through fiat pairs in Q1 declined from 15% in Q4 to 11%. The majority of XRP trading activity is currently against USDT.

The State of the XRP Ledger

XLS-30 Goes Live

Last quarter, after a vote approving the amendment, XLS-30 went live on the XRP Ledger Mainnet adding a non-custodial automated market maker (AMM) as a native feature to the XRPL’s decentralized exchange (DEX). This new feature was designed to provide on-chain liquidity and trading capabilities for DeFi developers and users, aggregating order books and liquidity pools at a protocol layer to facilitate the best price execution.

Note: shortly after going live, members of the community discovered a bug affecting the AMM functionality which prompted action from community developers and the RippleX team to address the issue. Following thorough testing, the AMM bug fix was released and successfully integrated into the Mainnet as of April 11.

XRPL Integrations

Axelar announced its integration to the XRP Ledger driving interoperability and expanding XRPL’s features to 55+ blockchains. This integration will enable developers to execute calls on smart contracts, facilitating the cross-chain deployment of decentralized applications on the XRPL. In addition, Zoniqx announced its plans to streamline the tokenization process for real-world assets with its integration of the XRPL and Orchestra Finance went live on Mainnet.

Lastly, EasyA launched educational modules and initiatives to onboard its community of over 750,000 developers onto the XRPL and its Ethereum Virtual Machine compatible sidechain. This will allow developers to more easily build decentralized applications with smart contract capabilities on the high-speed, low-cost XRPL.

On-Chain Activity

Last quarter, on-chain transactions increased by 108% and average cost per transaction decreased by 45%. Average transaction fee reached a high in December due to widespread testing of inscriptions on the XRPL. As such, the decrease in average cost per transaction indicated a reset and that no network congestion occurred in the quarter. For future reports, AMM volume will be included in the volume on DEX.

On-Chain Activity | Q4 2023 | Q1 2024 | QoQ |

Transactions | 121,031,713 | 251,397,881 | +108% |

XRP Burned for Transaction Fees | 317,271 | 636,184 | +101% |

Average Cost per Transaction (in XRP) | 0.00262 | 0.00147 | -44% |

Average XRP Closing Price (in USD) | 0.59 | 0.56 | -5% |

Average Cost per Transaction (in USD) | 0.001546 | 0.000856 | -45% |

Volume on DEX (in USD) | 54,907,170 | 64,857,084 | +18% |

Trustlines | 7,406,366 | 7,376,402 | -0.4% |

Number of New Wallets | 208,522 | 185,809 | -11% |

Feature Spotlight: Auto Bridging

Auto-bridging is a feature on the DEX that utilizes XRP as the native currency to facilitate trades between any two assets on the XRPL. As the native currency on XRPL, XRP is inherently counterparty free. Auto-bridging capitalizes on this by automatically considering XRP as a bridge currency to find the most efficient trading route across assets.

Auto-bridging works in conjunction with the XRPL's AMM function that went live on XRPL Mainnet. When an AMM trade occurs on the XRPL, it can create compatible trading offers for the auto-bridging feature. As such, AMMs increase available trading offers for auto-bridging, while auto-bridging expands AMMs' liquidity access. As XRPL adds assets and applications and AMM usage grows, auto-bridging will play a pivotal role in enhancing ecosystem functionality and interoperability.

Ripple’s XRP Holdings

Ripple reports information about its XRP holdings at the beginning of the quarter and last day of the quarter. Its holdings fall into two categories: XRP that it currently has available in its wallets, and XRP that is subject to on-ledger escrow lockups that will be released each month over the next 42 months.

For this latter category, Ripple does not have access to that XRP until the escrow releases it to Ripple on a monthly basis. The vast majority of the XRP released is put back into the escrow each month.

December 31, 2023

Total XRP Held by Ripple: 5,077,658,695

Total XRP Subject to On-Ledger Escrow: 40,700,000,005

March 31, 2024

Total XRP Held by Ripple: 4,836,166,156

Total XRP Subject to On-Ledger Escrow: 40,100,000,005

This report has been updated as of August 2, 2024.