Ripple publishes the quarterly XRP Markets Report to provide transparency and updates on the company’s views on the state of crypto markets and relevant XRP Ledger and XRP-related announcements. As an XRP holder, Ripple believes in proactive communication and transparency and urges others in the industry to foster open communication, build trust, and raise the bar industry-wide.

Key Highlights

- XRP’s status as not a security remains the law of the land. Ripple filed its Form C in response to the SEC's appeal, which does not concern whether XRP is a security.

- Ongoing headwinds from the SEC suggest that its lawsuit against Ripple is a key factor impacting XRP's price.

- Institutional interest in XRP investment products continued on a very positive trajectory with Bitwise, Canary, and 21Shares filing S-1s for XRP ETFs.

- Leading issuer Grayscale launched an XRP Trust and filed to convert a multi-coin fund that includes XRP into an ETF.

Crypto Markets Summary

Q3 2024 saw several factors impact market direction and sentiment including macroeconomic forces, a long-awaited ETH ETF listing, and growing speculation related to the U.S. presidential election.

The U.S. Federal Reserve cut rates by 50 basis points, after a prolonged period of tightening. This has seemingly paved the way for several other central banks—namely China, Japan, Europe and the UK—to follow suit with less restrictive policy. Risk assets, including cryptocurrencies, responded with BTC price increasing over 10% and several alt coins rising by 50% in the following days after the announcement.

In July, ETH ETFs made a landmark debut in the U.S., with issuers like BlackRock, Fidelity, and Grayscale entering the market. U.S. ETH ETFs have attracted $552.2 million so far, while U.S. Bitcoin ETFs have sustained impressive momentum, achieving a year-to-date inflow of $18.5 billion. In 2024, crypto ETFs have indisputably led the ETF space. Out of the 529 ETFs launched this year, BlackRock’s IBIT and Fidelity’s FBTC have captured top positions for highest inflows. Notably, among the top 50 ETFs by assets under management (AUM), 15 are now BTC- or ETH-focused.

With the court’s decision in the SEC's case against Ripple affirming that XRP is not, in and of itself, a security, XRP and BTC are still the only two tokens with regulatory clarity in the U.S. Since the ruling, every U.S. exchange that delisted XRP has relisted it, and global exchanges have made progress on the conflation issue between Ripple and XRP, correctly listing XRP on their platforms. The CME launched an XRP reference price and Bitnominal announced its intent to introduce an XRP futures product. Bitwise, Canary, and 21Shares filed S-1s for XRP ETFs, while Grayscale launched an XRP Trust and filed to convert its Digital Large Cap Fund—containing BTC, ETH, SOL, XRP, and AVAX—into an ETF. These filings mark a pivotal moment, underscoring institutional interest and demand for new products as XRP remains one of the top ten assets by market cap. As publicly reported, Ripple has invested in Bitnomial. It has also indicated an interest in investing in Bitwise, Canary, and 21Shares products as well as other exchange-traded products.

ETFs are a significant access point for investors—especially institutions—to gain exposure to digital assets. They are an important maturation step in any market, including crypto, as they bring legitimacy and trust, which can attract more traditional financial players into the space driving further adoption of cryptocurrencies.

Lastly, crypto markets have been increasingly focused on the upcoming U.S. presidential election and its resulting impact on future U.S. crypto regulation. The influence of the crypto voting bloc could become crucial to candidates’ chances of victory. With such narrow margins, voters invested in the future of crypto in the U.S., particularly in swing states, will likely play a decisive role in the outcome.

SEC Lawsuit: XRP is Not A Security Remains the Law of the Land

On August 7, the Judge issued a remedies order requiring Ripple to pay $125 million for certain historic unregistered sales of XRP to sophisticated third-party institutions. The amount is significantly lower than the unprecedented $2 billion in fines and penalties that the SEC had requested. There were no findings or allegations of fraud or recklessness against Ripple, or findings that anyone suffered any financial harm.

On October 2, the SEC indicated its intent to appeal the Court’s ruling that certain historical distributions of XRP by Ripple were securities. Importantly, the SEC appeal is not about whether XRP, in and of itself, is a security. The Court made that crystal clear when it ruled in Ripple’s favor in July 2023. It stated unequivocally that XRP, by itself, is not a security—and the SEC is not appealing that ruling. While the SEC’s decision to appeal other decisions was disappointing, it was not surprising given the Agency's ongoing war on crypto.

On October 24, Ripple filed its Form C outlining the issues the company plans to raise in its cross appeal. Considering that the parties are appealing the Court’s order, Ripple placed the $125 million allocated for remedies in an escrow account.

The appeal and cross-appeal briefing will stretch through the first half of 2025, followed by an argument before the appellate court, likely in Fall 2025, and a final ruling from the court thereafter.

Regulatory Developments

Crypto remained a key issue in the upcoming U.S. elections, with a “wave of crypto-friendly lawmakers” poised to usher in a new, bipartisan group of industry-friendly lawmakers across the House and Senate. The Washington Post reported that Fairshake, a PAC funded by the crypto industry, has spent more than $134 million this election cycle. Both Trump and Harris have made public comments regarding their stance on crypto, signaling openness to collaborating with innovative technologies and the crypto industry. Crypto advocate John Deaton secured the Republican nomination in Massachusetts, backed by figures like Brad Garlinghouse, Brian Armstrong, and Elon Musk. Ripple remains committed to supporting leaders who champion innovation in blockchain and crypto.

The SEC’s inconsistent and erratic enforcement caused further regulatory confusion in the industry. OpenSea received a Wells notice from the SEC, indicating potential legal action over claims that NFTs traded on its platform are securities. Additionally, the SEC sued Cumberland DRW, alleging that it has operated as an unregistered securities dealer. At the same time, the SEC finally admitted regret over using its invented term “crypto asset security,” acknowledging it caused confusion while claiming that it was not meant to suggest that a digital token itself was a security. SEC Commissioner Mark Uyeda slammed the agency’s crypto policy as a disaster, stating that guidance around what is (and is not) a security is unclear. Commissioners Uyeda and Peirce often vote for more progressive crypto policy moves.

Meanwhile, in Q3, several crypto companies sued the SEC, citing the regulator for overreach and complete disregard for the law. Bitnomial challenged the SEC’s authority over its XRP futures contracts, arguing the SEC wrongly classified XRP as a security and claims its product must be regulated by both the SEC and CFTC. In addition, Crypto.com sued the SEC after receiving a Wells notice in August, disputing claims that some platform tokens like SOL and ADA qualify as securities, arguing the SEC is unlawfully expanding its jurisdiction. The company also petitioned both the SEC and CFTC to confirm that certain crypto derivatives fall solely under CFTC regulation.

Lastly, Operation Chokepoint 2.0 made headlines following another enforcement action by the current administration. The U.S. Federal Reserve issued a cease-and-desist order to United Texas Bank, citing "significant deficiencies" in its risk management systems, particularly related to its crypto client dealings. This marked the second recent action against a crypto-friendly bank, following a similar order against Customers Bancorp.

In contrast to the U.S., many jurisdictions globally continue to embrace crypto and have clarified any regulatory ambiguity in seeking to help the industry grow and thrive within their borders. In APAC, Japan is reportedly set to review its crypto regulations, potentially lowering taxes on digital assets and enabling domestic funds to invest in tokens. South Korea's Financial Services Commission may also reconsider its ban on spot crypto ETFs, indicating a shift away from strict opposition to digital asset exposure in traditional financial markets. Additionally, the Hong Kong Monetary Authority (HKMA) published its conclusions following a consultation on a stablecoin regulatory regime; the regulator is now working on an implementing bill for fiat-referenced stablecoins, which will be tabled before the city state's Legislative Council later this year. In the Middle East, the UAE continues to position itself as a blockchain and crypto-friendly jurisdiction. Ripple received in-principle approval from the Dubai Financial Services Authority (DFSA) to expand its payment solutions from the Dubai International Financial Centre (DIFC), making it the first blockchain-enabled payment services provider licensed by the DFSA. Furthermore, the UAE has retroactively exempted crypto transactions from value-added tax (VAT) since January 2018, aligning the industry with traditional financial services.

Deep Dive: XRP Markets

For this report, Ripple uses market metrics from public sources including CCData, Bloomberg, and Refinitiv Eikon.

Taking a look at XRP markets in Q3, XRP volumes were elevated as average daily volumes (ADV) were at $600-700 million on top-tier exchanges. The XRP/BTC ratio increased 27% over Q3. This is particularly significant during a time when Bitcoin dominance (BTC.D) also increased steadily, with a total rise of 3% during the quarter.

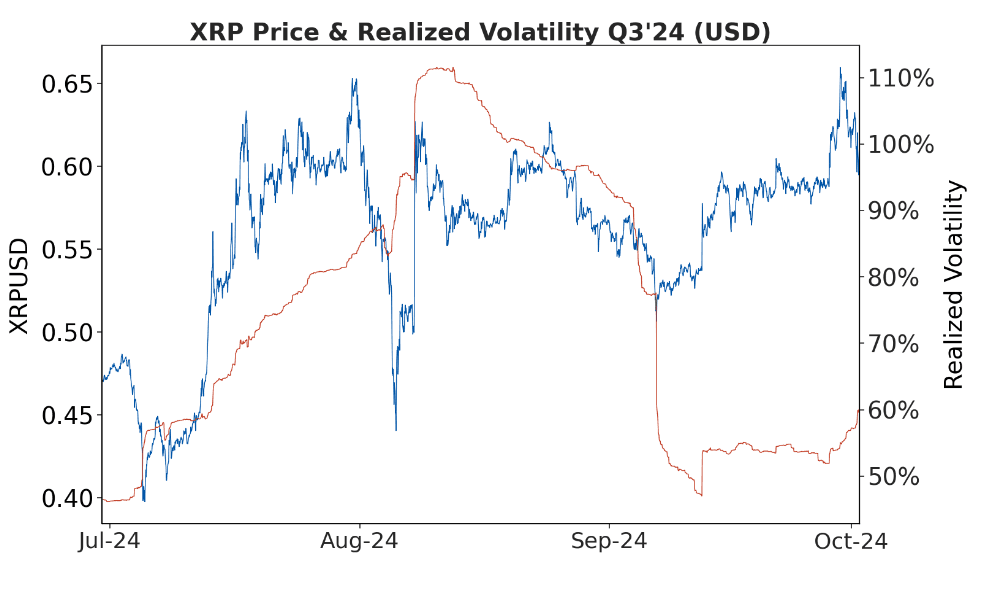

Chart 1:

XRP realized volatility increased during the first half of Q3 2024, peaking in mid-August at more than double, exceeding 110%, due to wide price swings from 40 US cents to 65 US cents. The second half of the quarter saw a more range-bound price movement, with realized volatility declining to around 60%.

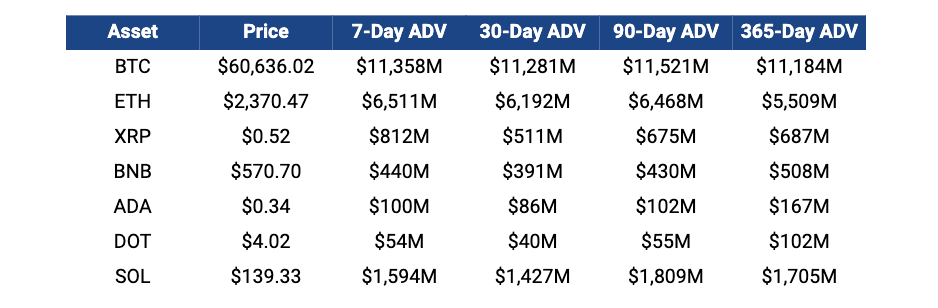

Table 1: Major Tokens Price and Volume (End of Q3‘24 figures)

USD prices and average trading volume reflects daily trading activity for the USD and stablecoin pairs on top tier exchanges as measured by CCData.

Chart 2: XRP Spot Exchange Volume

Traded volumes remained higher compared to the preceding two quarters, with larger volumes observed on Binance, Bybit, and Upbit. Notably, the first half of the third quarter saw substantial volumes, averaging $750 million daily, before stabilizing in the second half and then picking up again in the final days of September.

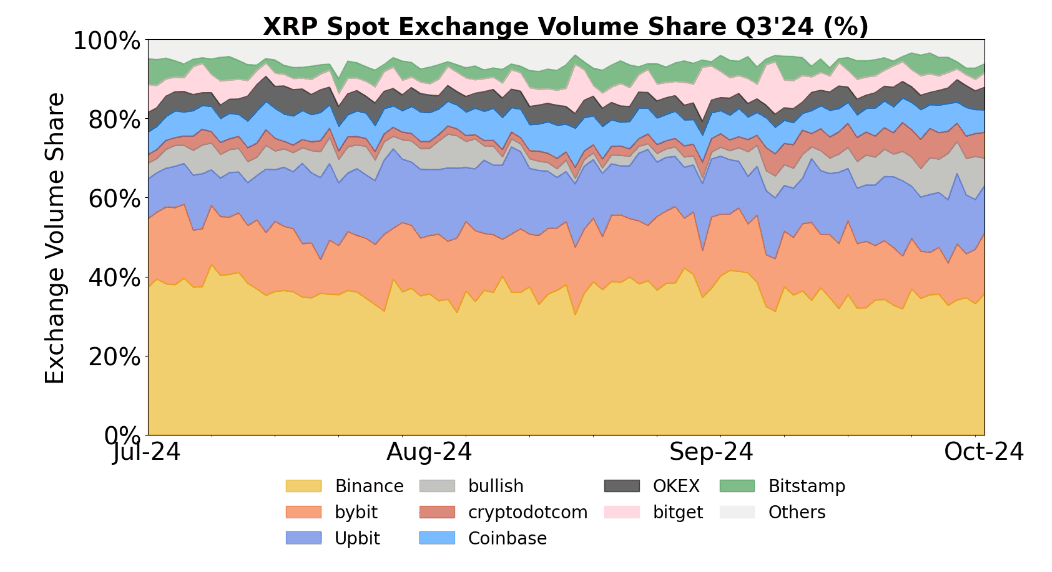

Chart 3: XRP Spot Exchange Volume Share (%)

Similar to the first half of the year, XRP volume distribution across exchanges remained relatively constant throughout the third quarter. Binance, Bybit, and Upbit accounted for well over 65% of the total traded volume, with a slight decline in Binance’s share (-3 percentage points compared to Q2) and an increase on CryptoDotCom (+6 percentage points compared to Q2).

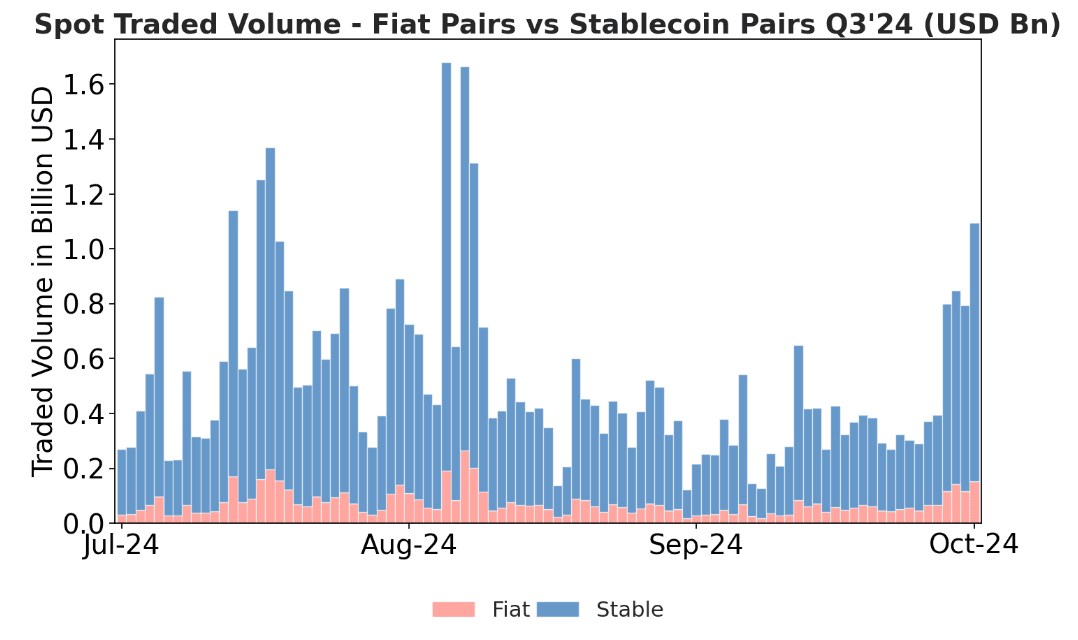

Chart 4: Spot Traded Volume

The percentage of volume traded through fiat pairs increased from 10% in Q2 to 14% in Q3. The majority of XRP trading activity continues to be against USDT.

The State of the XRP Ledger

Expanding Programmability on the XRP Ledger

Ripple and the broader XRP community announced their commitment to introduce advanced programmability, including smart contracts, to the XRP Ledger developer ecosystem. Programmability on the XRP Ledger will improve through two key developments: the introduction of native smart contract capabilities on the XRP Ledger Mainnet and the XRPL EVM Sidechain (which is already underway).

- Native Smart Contract Features: The main pathway for adding programmability to the XRPL is through the amendment process, which requires over 80% of validators to agree. Features added through this process are integrated natively into the entire network, ensuring the security, performance, and stability of the overall network.

- The XRPL EVM Sidechain: This sidechain allows developers to deploy smart contracts quickly without the need for network-wide agreement. This development is already in progress, led by partner Peersyst, and will use Axelar as the bridge to enable cross-chain transitions with the XRPL mainnet and over 55 blockchains.

Existing smart contract standards, such as Hooks from XRPL Labs, have already laid an important foundation for programmability on the XRP Ledger. In collaboration with the community, Ripple will evaluate the best way to meet these requirements on Mainnet and publish an XLS proposal for broader community review.

Ripple USD

Ripple announced its initial exchange partners and advisory board for Ripple USD (RLUSD). Through strategic partnerships, RLUSD will be available globally for institutions and users worldwide on global exchanges and platforms including Uphold, Bitstamp, Bitso, MoonPay, Independent Reserve, CoinMENA, and Bullish. Leading market makers, such as B2C2 and Keyrock, will support the liquidity of RLUSD driving broader adoption across markets.

In addition, RLUSD is one of the few stablecoins issued under a New York Trust Company Charter, ensuring rigorous oversight and regulation. Ripple has assembled an advisory board, including former Federal Deposit Insurance Corporation (FDIC) Chair Sheila Bair, former CENTRE Consortium CEO David Puth, and Ripple co-founder and Executive Chairman Chris Larsen to provide strategic guidance on regulatory, financial, and operational aspects to support RLUSD’s stability and growth in the market. It also fosters relationships with key stakeholders to enhance market confidence and promote best practices within the stablecoin landscape.

On-Chain Activity

On-chain activity rebounded from the dip in May and June, with the number of successful transactions more than doubling compared to Q2. However, despite the increase in activity, much of it involved small-volume transactions, so total on-chain volume did not see a significant rise. The uptick was primarily driven by microtransactions (<1 XRP), which appeared to be part of a spam messaging campaign.

Despite a drop in DEX volume, the Total Value Locked (TVL) in Automated Market Makers (AMMs) grew significantly, doubling from $8.5 million to $16.2 million. The most notable TVL increases were seen in the CRYPTO/XRP (Cryptoland) and MAG/XRP (Magnetic) pools.

| On-Chain Activity | Q2 2024 | Q3 2024 | QoQ |

|---|---|---|---|

| Transactions | 86,388,029 | 172,601,689 | +99% |

| XRP Burned for Transaction Fees | 495,770 | 598,477 | +21% |

| Average Cost per Transaction (in XRP) | 0.00394 | 0.00269 | -32% |

| Average XRP Closing Price (in USD) | 0.52 | 0.55 | +5.7% |

| Average Cost per Transaction (in USD) | 0.002064 | 0.001512 | -27% |

| Volume on DEX (in USD) | 37,126,655 | 24,658,159 | -33% |

| Trustlines | 7,325,547 | 7,249,570 | -1% |

| Number of New Wallets | 100,746 | 111,967 | +11% |

Ripple’s XRP Holdings

Ripple reports information about its XRP holdings at the beginning of the quarter and last day of the quarter. Its holdings fall into two categories: XRP that it currently has available in its wallets, and XRP that is subject to on-ledger escrow lockups that will be released each month over the next 42 months.

For this latter category, Ripple does not have access to that XRP until the escrow releases it to Ripple on a monthly basis. The remaining XRP released is put back into the escrow each month.

Note: From time to time, Ripple supports or transfers to third parties, such as ETPs, trusts, and other investments, XRP that Ripple reasonably expects to maintain in its holdings. When doing so, a reduced amount of XRP may be returned to escrow that month. Until and unless Ripple expects such XRP to enter the broader market (through, for example, further transfers to third parties), that XRP is included in “XRP Held by Ripple.”

June 30, 2024

Total XRP Held by Ripple: 4,682,112,997

Total XRP Subject to On-Ledger Escrow: 39,500,000,005

September 30, 2024

Total XRP Held by Ripple: 4,436,713,796

Total XRP Subject to On-Ledger Escrow: 38,900,000,005